About this Event

Reparation Nation Limited: Financing Plan for ADEJA

Executive Summary

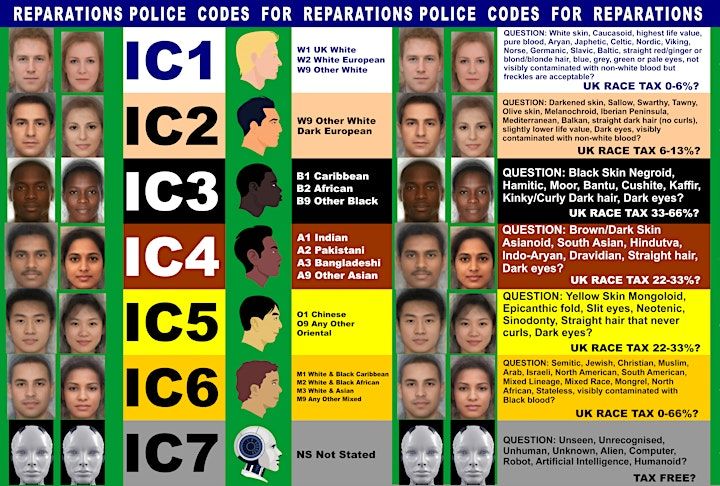

Reparation Nation Limited (RNL) aims to raise finance for establishing the African Diaspora Equity and Justice Alliance (ADEJA), an international organization focused on processing and distributing reparation claims for Black Africans, the Black African diaspora, and the Mixed-Black diaspora. ADEJA's mission aligns with the UK's national security interests, promoting racial equity, and enhancing the UK's global leadership in human rights.

Objectives

- Raise Capital: Secure funds through bond issuance and other financial instruments.

- Establish ADEJA: Form a robust international entity to manage reparation claims.

- Promote Racial Equity: Ensure the mission of ADEJA aligns with global human rights standards.

- Enhance Global Leadership: Position the UK as a leader in addressing historical injustices.

Bond Issuance: ADEJA Reparation Bonds

Bond Name: ADEJA Reparation Bonds

Tagline: "Invest in Justice, Empower the Future"

- Bond Type: Fixed-rate corporate bonds.

- Maturity: 10 years.

- Coupon Rate: Competitive interest rate, benchmarked against UK government bonds plus a risk premium.

- Denomination: GBP 1,000 per bond.

- Minimum Investment: GBP 10,000.

- Total Issue Size: GBP 500 million.

Target Investors:

- Institutional investors

- ESG (Environmental, Social, and Governance) funds

- High-net-worth individuals

- Philanthropic organizations

- Socially responsible investors

Distribution Channels:

- Investment banks

- Financial advisors

- Online investment platforms

- Social media and digital marketing

Marketing Campaign:

- Message: Highlight the social impact and alignment with UK government goals on racial equity and national security. Emphasize the transformative potential of the investment for Black communities worldwide.

- Materials: Create brochures, presentations, and informational videos explaining the mission, structure, and benefits of the ADEJA Reparation Bonds.

- Events: Host webinars, seminars, and investor meetings to present the bonds and answer questions from potential investors.

- Media: Engage with financial news outlets, blogs, and social media influencers to spread the word about the bonds.

- ADEJA Establishment: Legal, administrative, and operational setup.

- Reparation Fund: Initial pool for processing and distributing reparation claims.

- Operational Costs: Staffing, technology, and infrastructure.

Strategic Partnerships

Government Support:

- Secure endorsements and potential guarantees from the UK government to enhance bond credibility and appeal to investors.

Private Sector Collaboration:

- Partner with corporations and foundations focused on social justice and racial equity to co-fund specific initiatives within ADEJA.

Alternative Financing

Grants and Donations:

- Apply for grants from international organizations, philanthropic foundations, and NGOs.

- Launch a global donation campaign targeting the African diaspora and allies worldwide.

Implementation Plan<h4>Phase 1: Initial Setup (Months 1-6)</h4>

- Legal Framework: Establish ADEJA as an international entity.

- Team Recruitment: Hire key personnel including legal, financial, and operational experts.

- Bond Issuance Preparation: Finalize bond terms, secure underwriters, and prepare marketing materials.

- Bond Launch: Initiate bond issuance, targeting institutional investors first.

- Public Campaign: Roll out marketing and public relations campaign to raise awareness and attract investors.

- Strategic Partnerships: Formalize agreements with government and private sector partners.

- Infrastructure Development: Set up offices, IT systems, and administrative processes.

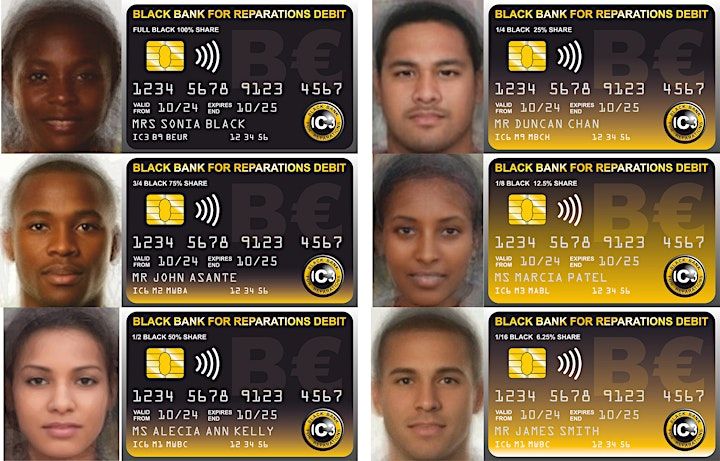

- Reparation Fund Activation: Start processing and distributing claims based on evidence-based criteria.

- Monitoring and Evaluation: Establish systems for tracking progress, impact assessment, and reporting to stakeholders.

Risk Management

Financial Risks:

- Mitigate through government guarantees and strong investor relations.

Operational Risks:

- Ensure robust governance structures and compliance with international standards.

Reputational Risks:

- Maintain transparency and engage with stakeholders through regular updates and consultations.

Potential Impact

Social and Economic Benefits:

- Empower Black communities through targeted reparations.

- Promote social cohesion and racial equity.

- Enhance UK's reputation as a leader in human rights and social justice.

Investor Benefits:

- Attractive fixed returns with the added value of contributing to a significant social cause.

- Potential government backing reduces risk exposure.

Conclusion

Reparation Nation Limited's strategic plan to raise finance through bond issuance and other means for ADEJA presents a unique opportunity to address historical injustices while promoting social and racial equity. This initiative aligns with the UK's national interests and offers a compelling investment proposition for those committed to social impact.

Event Venue & Nearby Stays

SOAS University of London, 10 Thornhaugh Street, London, United Kingdom

GBP 0.00