About this Event

VITA PROGRAM – VOLUNTEER TRAINING INFORMATION

The Volunteer Income Tax Assistance Program (VITA) offers free basic tax help to individuals who meet the eligibility requirements.

The VITA program has been operating for over 50 years, providing free assistance to people who need help preparing their own tax returns.

El Centro will train all volunteers and provide the necessary materials to get certified, depending on the type of volunteering you choose. This certification allows you to prepare taxes ONLY through this program and our organization.

"Join our volunteer team during tax season and gain hands-on experience preparing federal and state tax returns."

We are planning a total of 7 training sessions:

- 3 in Spanish

- 3 in English

- 1 practice session (bilingual)

- 1 optional Q&A session

All sessions will take place from 6:00 pm to 8:00 pm.

Spanish Sessions

- Wednesday, January 14 – Spanish

- Tuesday, January 20 – Spanish

- Wednesday, January 28 – Spanish

- Practice Session: Thursday, February 5 – Bilingual

- Optional Session: Tuesday, February 10 – Questions

English Sessions

- Thursday, January 15 – English

- Wednesday, January 21 – English

- Thursday, January 29 – English

- Practice Session: Thursday, February 5 – Bilingual

- Optional Session: Tuesday, February 10 – Questions

Registration

It is necessary to reserve a spot for each training session, either in English or Spanish.

Orientation is mandatory.

There are many ways to contribute while learning and developing new skills.

We look forward to having you on our team!

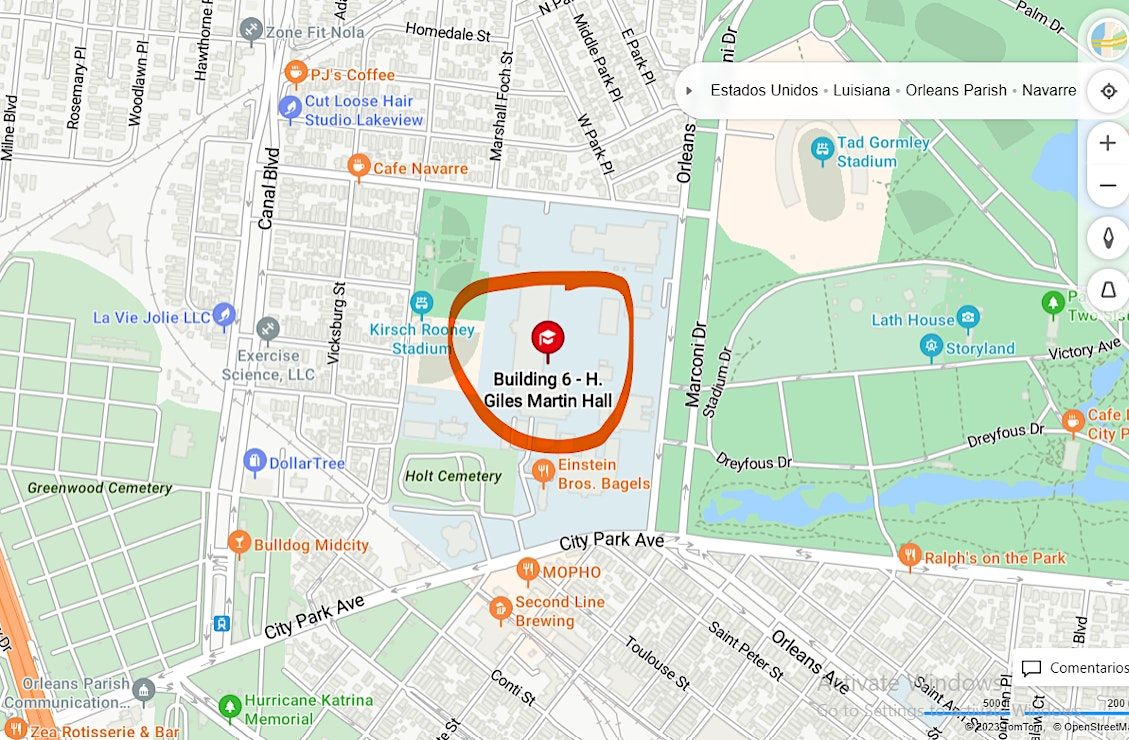

Use this map to directios

Agenda

🕑: 06:00 PM - 08:00 PM

14 de Enero: Orientación en Español

Info: Orientación en Español. Aprenderás las posiciones diferentes de Voluntarios. Revisaremos las fechas importantes y realizaremos 2 exámenes básicos sobre Estándares de Conducta y Hoja de Entrevista.

🕑: 06:00 PM - 08:00 PM

January 15th English Orientation Training

Info: Orientation is where you learn about important dates. We will take 2 basic Volunteer Standards of Conduct and Intake/Interview and Quality Review Exams

🕑: 06:00 PM - 08:00 PM

20 de Enero: Entrenamiento 1 en Español

Info: En esta sesión aprenderás: ¿Qué contiene una declaración de Impuestos?, Cuáles son los Ingresos Taxables, El Estado Civil y Deducción Estándar, Créditos Fiscales Comunes, etc.

🕑: 06:00 PM - 08:00 PM

January 21 English Training I

Info: In this session you will learn: What goes into a tax return?, What is Taxable Income?, Filing Status and Standard Deduction, Common Tax Credits, Tax Forms, etc.

🕑: 06:00 PM - 08:00 PM

28 de Enero: Entrenamiento 2 en Español

Info: En esta sesión, examinaremos el Formulario 1040 y la Hoja de Schedule C (Ingresos y Gastos), así como la Hoja de Contabilidad de El Centro. Además, realizaremos un ejercicio práctico de contabilidad y aprenderemos qué es un número ITIN y cuáles son sus beneficios.

🕑: 06:00 PM - 08:00 PM

January 29 English Training III

Info: In this session You will learn: How is reading form 1040, Schedule C- Income and Expense Form, El Centro Accounting Form, Accounting Exercise, Individual Tax Identification Number (ITIN)

What is it? Who needs one? What are the benefits?

🕑: 06:00 PM - 08:00 PM

5 de Febrero/February 5: Práctica/Extra Information, Questions, Overview.

Info: En esta sesión p´racticaremos en equipo con recursos necesarios y ejercicios iteractivos básicos. Agendarás el horario de citas y eventos que tendremos y en los que podrás participar y resolveremos las preguntas generales sobre el examen. / Program Schedule & Events, Questions?

🕑: 06:00 PM - 08:00 PM

10 de Febrero/February 10 Opcional Preguntas/Questions

Event Venue & Nearby Stays

Building 6 - H. Giles Martin Hall, 615 City Park Avenue, New Orleans, United States

USD 0.00