About this Event

Group Discounts:

Save 10% when registering 3 or more participants

Save 15% when registering 10 or more participants

For more information on Venue address, reach out to "[email protected]"

About This Course

- Duration: 1 Full Day (8 Hours)

- Delivery Mode: Classroom (In-Person)

- Language: English

- Credits: 8 PDUs / Training Hours

- Certification: Course Completion Certificate

- Refreshments: Lunch, snacks, and beverages provided

Course Overview

This 1 Day workshop provides a practical, beginner-to-intermediate understanding of U.S. Sales & Use Tax, the closest equivalent to GST in the United States. You will explore how state tax authorities conduct audits, how businesses are assessed for additional tax, how nexus determines multi-state obligations, how notices and penalties are issued, and what steps are required to dispute or appeal findings.

The course focuses on real U.S. scenarios: nexus misinterpretation, incorrect exemption certificate handling, sampling audits, multi-state risks, state-level disputes, and basic litigation pathways. By the end, you will know how to prepare for audits, defend documentation, handle assessments, and reduce future exposure.

. Learning Objectives

By the end of this course, you will be able to:

- Understand how U.S. states enforce sales & use tax compliance.

- Recognize nexus triggers and multi-state obligations.

- Prepare for and respond correctly to state audit procedures.

- Identify common exposure areas and prevent costly errors.

- Understand assessments, penalties and interest calculations.

- Navigate basic dispute and appeal processes.

- Build a practical audit-readiness and compliance improvement plan.

8. Target Audience

- Indirect tax & compliance teams

- Accountants & finance professionals

- Business owners, CFOs, controllers

- E Commerce, retail, SaaS & service providers

- Internal auditors and operational managers

- Anyone handling sales & use tax obligations

Why Choose This Course?

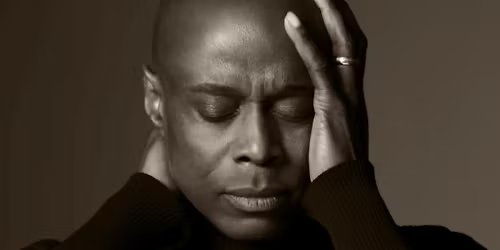

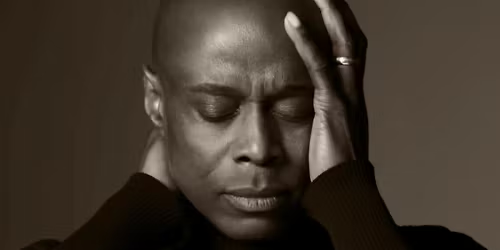

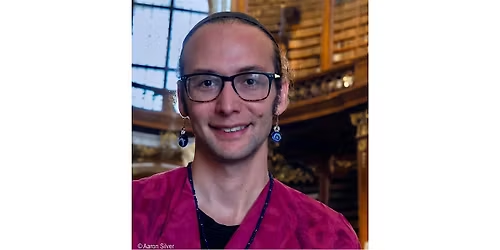

This program translates complex U.S. indirect tax rules into clear, actionable steps for beginners advancing to intermediate-level understanding. The trainer brings experience from multi-state audits, nexus compliance, assessments, exposure reviews, exemption certificate issues, and dispute processes—ensuring real-world insights, not theory. The content is structured so you walk away with practical audit-readiness skills you can apply immediately.

©2025 Mangates Tech Solutions Pvt Ltd. This content is protected by copyright law. Copy or Reproduction without permission is prohibited.

Our Royalty Referral Program

Know a team or professional who could benefit from our workshops? Refer them and earn attractive royalties for every successful registration.

For royalty-related queries, contact [email protected]

Want to train your entire team on U.S. indirect tax audits and compliance?

We provide customized in-house sessions tailored to your industry, state footprint, risk areas, and audit history. Your team learns how to manage nexus obligations, strengthen documentation, minimize exposure, and respond confidently to multi-state audit reviews. Custom scenarios and examples can be included.

📧 Contact us today to schedule a customized in-house session:

Agenda

Module 1: U.S. Sales & Use Tax Framework & Nexus Concepts

Info: • Differences between sales tax, use tax & taxable/exempt transactions

• Economic nexus, physical nexus, marketplace facilitator rules

• Understanding multi-state compliance complexity

• Icebreaker Activity

Module 2: State Audit Process & Documentation Requirements

Info: • How state authorities initiate audits & select sample periods

• Required documents: invoices, resale/exemption certificates, reconciliations

• Responding accurately to notices and data requests

• Activity

Module 3: Common Sales & Use Tax Errors Identified in Audits

Info: • Misapplied tax rates and incorrect taxability decisions

• Improper exemption certificate management

• Use tax exposure on purchases and asset acquisitions

• Role Play

Module 4: Assessments, Penalties & Interest in the U.S. System

Info: • How additional tax, penalties & interest are calculated

• Understanding negligence, fraud, late filing & under-collection penalties

• Options for payment plans, settlement & penalty mitigation

• Case Study

Module 5: Disputes, Appeals & State Litigation Pathways

Info: • Administrative review → protest → appeals → possible court escalation

• Preparing evidence, documentation and written arguments

• How businesses negotiate or settle state-level disputes

• Simulation

Module 6: Multi-State Exposure & Risk Management

Info: • Identifying exposure across several states

• Common risk areas for eCommerce, services & remote sellers

• Using internal controls to reduce assessment risk

• Group Brainstorm Activity

Module 7: Building an Audit-Ready Indirect Tax Compliance Plan

Info: • Creating taxability matrices & reconciliation checks

• Strengthening document retention for audits

• Developing ongoing audit-readiness processes

• Action Plan Review

Event Venue & Nearby Stays

100 Church St, 100 Church Street 8th Floor New York City New York 10007 United States of America, New York, United States

USD 551.40 to USD 716.28