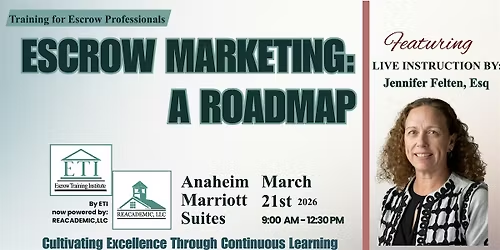

About this Event

Stay current on the latest real estate tax laws, regulations, and reporting changes that impact escrow, brokerage, and real estate transactions. This timely update session breaks down new developments in an easy-to-understand format, helping you stay compliant and informed in today’s evolving tax environment.

What You’ll Learn

- The latest federal and state tax code updates affecting real estate

- How new regulations impact escrow procedures and documentation

- FIRPTA and 593 withholding updates and enforcement trends

- 1099-S reporting changes and best practices

- Tax considerations for trusts, estates, and entity transactions

- Common compliance pitfalls and how to avoid them

- Practical insights from real-world scenarios and DRE guidance

Stay informed, stay compliant, and keep your transactions running smoothly with the most up-to-date tax knowledge in the industry.

Event Venue & Nearby Stays

Anaheim Marriott Suites, 12015 Harbor Boulevard, Garden Grove, United States

USD 160.83