About this Event

Group Discounts:

- Save 10% when registering 3 or more participants

- Save 15% when registering 10 or more participants

Duration: 1 Full Day (9:00 AM – 5:00 PM)

Delivery Mode: Classroom (In-Person)

Language: English

Credits: 8 PDUs / Training Hours

Certification: Course Completion Certificate

Refreshments: Lunch, beverages, and light snacks included

Course Overview

The Retirement Plans for Mid-Aged course is designed to help you strategically plan your financial future and lifestyle stability post-retirement. Learn how to assess retirement goals, build a diversified portfolio, manage risks, and ensure a sustainable income for years to come. This program empowers you to take control of your retirement planning through evidence-based financial strategies and practical tools.

Learning Objectives

By the end of this course, you will:

- Calculate your retirement income needs based on lifestyle goals

- Evaluate a range of retirement investment instruments

- Apply tax-efficient strategies to maximize retirement savings

- Design a sustainable budget and income stream post-retirement

- Manage inflation, risk, and longevity with practical tools

- Create an actionable personalized retirement plan

Target Audience

Mid-career professionals, managers, and self-employed individuals.

Why is it right fit for you:

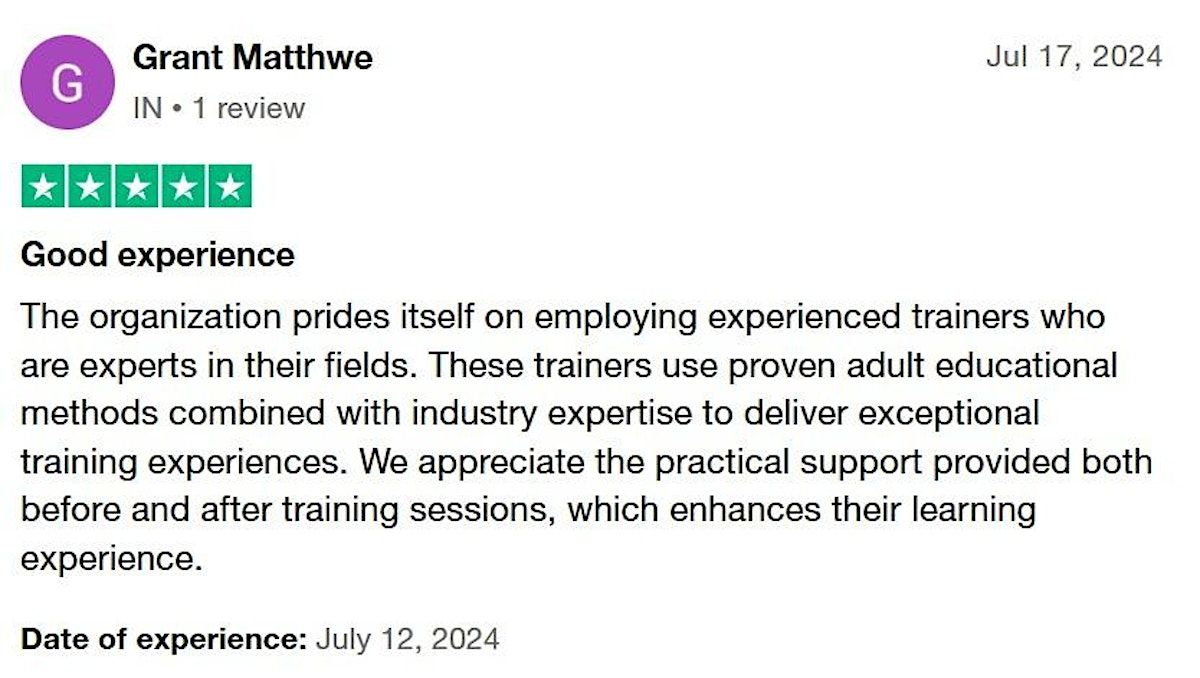

If you’re in the middle of your career and looking to secure your financial future, this course gives you the clarity and confidence you need. We combine financial expertise with actionable tools and real-world insights, helping you build a resilient and flexible retirement strategy. You’ll walk away with a customized plan that aligns your finances with your post-career dreams. Whether you’re aiming for a peaceful retirement, continued income, or legacy planning, this course puts you in control.

©2025 Catils. This content is protected by copyright law. Copy or Reproduction without permission is prohibited.

Does your organization want to support its employees in securing their financial future?

We offer customized in-house retirement planning training to help your team build smarter financial habits and long-term stability. Want to add value to your employee benefits program? Let us tailor a practical retirement-focused financial literacy workshop for your workforce.

📧 Contact us today to schedule a customized in-house, face-to-face session:

Agenda

Module 1: Introduction to Retirement Planning

Info:

• Importance of proactive financial planning

• Calculating retirement income needs

• Common retirement planning pitfalls

• Activity

Module 2: Assessing Your Retirement Needs

Info:

• Lifestyle and expense forecasting

• Retirement goal mapping

• Determining income gaps and funding needs

• Case Study

Module 3: Investment Options for Retirement

Info:

• Stocks, mutual funds, bonds, and index funds

• Real estate and passive income streams

• Diversification strategies

• Activity

Module 4: Tax Planning Strategies

Info:

• Tax-efficient investment selection

• Retirement account types and tax benefits

• Managing taxable and tax-deferred assets

• Case Study

Module 5: Managing Financial Risk

Info:

• Impact of inflation and market volatility

• Insurance for health and long-term care

• Building an emergency contingency fund

• Activity

Module 6: Budgeting & Cash Flow During Retirement

Info:

• Creating a realistic retirement budget

• Managing withdrawals wisely

• Balancing fixed and flexible expenses

• Activity

Module 7: Estate & Wealth Protection

Info:

• Essentials of wills and trusts

• Legacy planning strategies

• Protecting wealth across generations

• Case Study

Module 8: Personalized Plan Development

Info:

• Building your customized retirement roadmap

• Reviewing plan feasibility and adjustments

• Creating action steps for execution

• Activity

Event Venue & Nearby Stays

Regus - ON, London – London City Centre, 380 Wellington Street, Tower B, 6th Floor, London,, Canada

CAD 559.16 to CAD 724.76