About this Event

Join us for a private Family Office Insights Webinar featuring Susan Lindeque a visionary entrepreneur, founder, and global finance leader, CEO and Founder of Avestix Group.

Avestix is an emerging, cutting-edge alternative investment platform on a mission to raise and manage a billion dollars of investor capital in the coming years. Avestix is a USA based, woman-owned and led business, anchored in a single family office structure. Avestix is a multi-asset investment manager, with an initial focus on commercial real estate.

Susan Lindeque is a proven entrepreneur - boasting over 35 years of experience in corporate finance, technology, commercial real estate, and venture capital – across three continents. Historically, over $1 Billion in Real Estate Transactions Capital Raised, Invested, Financed and Project Managed: a testament to her ability to secure financing for large projects but also effectively manage them. Such scale of financing and project management reflects capabilities in high-level negotiations, advanced financial structuring, and effective project execution.

About Avestix Group

Avestix is a dynamic, emerging alternative investment firm based in West Palm Beach; with satellite offices in Miami and New York.

Avestix launched a commercial real estate fund in 2024 and intends to capitalize the fund with $100 million or more in the coming year – the firm is also involved in selecting opportunistic venture capital investments.

At Avestix Group, our decades of global expertise in direct operating roles, acquisitions, governance, and private company investing set us apart, we recognize the importance of relevant experience to institutional managers and qualified private investors.

Key metrics of Avestix and Founder:

1. 100+ acquisition transactions completed

2. 70+ off-market properties acquired and managed

3. $86M jointly invested alongside partners

4. $1B+ in real estate transactions capital raised, invested, financed, and project-managed

Avestix is anchored in an impressive and actionable long-term track record across alternative investment assets classes spanning three continents. Our strategic positioning and innovative investment approach provide a unique opportunity for above-average returns in a dynamic economic landscape. Avestix ownership is dedicated to formidable success through the principles of innovation, forward thinking, collaboration, integrity, and a commitment to hard work and excellence.

Target Audience

Real Estate (directs and fund)

The focus is on multi-family developments or special situation assets, starting with significant projects in West Palm Beach—a region experiencing remarkable demographic and commercial maturation and investment interest. The firm has secured an exclusive joint venture agreement with a prominent commercial real estate company; specializing in multi-family apartments, logistic warehouse and datacenters with a focus on Florida and Sweden. Avestix has engaged in the first five real estate targets in West Palm Beach which include commercial real estate buildings that have office, hotel and restaurant, and land parcels to be developed into 602 multifamily rental units.

Differentiators

Avestix is a unique investment company, and we are currently at a pivotal moment of acceleration as we are building a multi-fund Alternative Investment Platform (“AVXI”), women owned, anchor in Family Office.

Expertise and Excellence:A team of highly skilled professionals leads Avestix, which has an impressive track record in alternative investments. Their expertise and dedication ensure that every investment decision is well-informed and strategically sound.Diversification at Its Core:Avestix embraces the power of diversification by carefully selecting investments across a spectrum of alternative asset classes. This approach minimizes risk while maximizing potential returns for investors like you.Unlocking Growth Opportunities:Alternative investments offer a unique way to unlock growth potential that may not be available through traditional investment avenues. Avestix actively seeks these opportunities, positioning itself as a wealth creator and expansion catalyst.

A Long-Term Vision:Avestix long-term perspective focuses on sustainable growth and value creation

Business Status

Avestix has been 9 years in the making. The founder and CEO, Susan Lindeque's entrepreneurial journey is impressive, especially considering she started at such a young age. Beginning at an early age in residential real estate and then transitioning into commercial real estate indicates a deep-rooted passion and understanding of the industry. Expanding the firm during covid into the US, she started to look for strategic corporate and real estate partners. The firm in recent months initiated and concluded significant corporate partnerships with the firm, including Deloitte, KPMG, Grant Thornton, DLA Piper, Day Pitney, and Apex.

Funding Status

The Founder, Susan Lindeque’s family office has made a significant investment of their own capital in the company and started a holding company.

Additionally, the joint venture development company already contributed 50% in the office, hotel and restaurant and up to 20% equity in the ground up development of 602 multi-family apartments with an LTC of 60% of the construction.

Avestix as the General Partner is raising the initial funding of $25M in equity with an anticipated second closing by September 2024 $35 million and an anticipated third closing by Nov 2024 of $40 million.

The capital is expected to be repaid over 5 years with 2 one-year extensions.

Target IRR is 15% plus with cash on cash 2.5% and equity multiple of 1.75X

Team

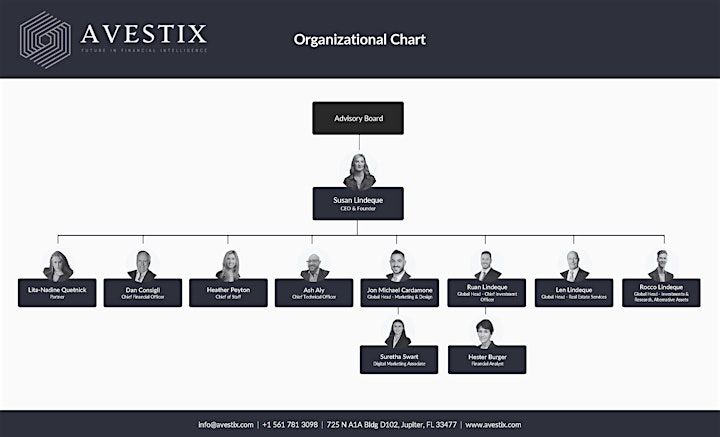

Avestix team consists of 11 employees, one special advisor and advisory board to be in place by May 2024.

See attachment of Avestix Group Organizational Chart

Disclaimer:

The information contained in this email is being provided to you for informational purposes only and is not an offer to sell or the solicitation of an offer to purchase an interest in any investment vehicle or account managed or sponsored by Avestix General Manager LLC or its affiliates (collectively, “Sponsor”). Any such offer, sale or solicitation of interests in any investment vehicle or account managed or sponsored by Sponsor, will be made only pursuant to offering documents related thereto and subject to the terms and conditions contained therein. The information contained in this email may be confidential and/or legally privileged. It has been sent for the sole use of the intended recipient(s). If the reader of this message is not an intended recipient, you are hereby notified that any unauthorized review, use, disclosure, dissemination, distribution, or copying of this communication, or any of its contents, is strictly prohibited. If you have received this communication in error, please reply to the sender and destroy all copies of the message.

Event Venue

Online

USD 0.00