About this Event

Pixar's IPO roadshow in November 1995 was a high-wire act. Two weeks before the premiere of Toy Story—the first feature-length computer-animated film—Steve Jobs barnstormed the country with hand-picked investment bankers, trying to sell Wall Street on his $50 million passion project.

Besides a volatile CEO and skeptical investors, what could go wrong?

How about a company with no revenues, no feature film track record, and a blizzard in New York that forced an all-night drive to Boston to save the roadshow? Instead of his first or second choices, Goldman Sachs and Morgan Stanley, Jobs had to work with Robertson Stephens, Hambrecht & Quist, and Cowen.

Defying expectations, Toy Story opened to rave reviews and boffo box office. Just days later, Pixar stock exploded from $22 to $39 on its first day of trading, becoming 1995's largest IPO and vindicating Jobs with a billion-dollar fortune while cementing his visionary reputation.

Pixar's IPO turned out to be a watershed moment in the history of digital technology and finance, demonstrating that institutional investors had developed an appetite for pre-revenue companies whose technology promised to reshape entire industries. The deal also marked the rise of boutique West Coast investment banks like H&Q and Robertson (two of what became the legendary "Four Horsemen") who saw emerging growth opportunities that their bulge bracket New York competitors missed.

30 years later, join the Computer History Museum for a special CHM Live program with the dealmakers who defied the odds: Lawrence Levy (Pixar CFO), Mike McCaffery (Robertson Stephens CEO), and Cristina Morgan (Hambrecht & Quist Head of Technology Investment Banking). Hear the untold stories behind one of Silicon Valley's most improbable successes from the individuals who made history happen.

Agenda

🕑: 05:30 PM

Check-In

🕑: 06:00 PM - 07:30 PM

Program

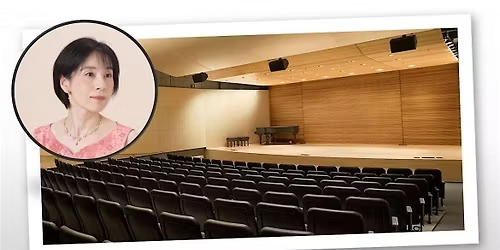

Event Venue & Nearby Stays

Computer History Museum, 1401 North Shoreline Boulevard, Mountain View, United States

USD 0.00