About this Event

Event Description

Are you paying more in taxes than you should?

Join Unlimited CashFlow Solutions & Minerva Tax Advisory + Consulting for a FREE in-person workshop where we break down powerful tax-saving strategies using real estate—in a way that’s easy to understand and immediately actionable.

Whether you’re:

- A real estate investor (new or experienced)

- A business owner or entrepreneur

- A W-2 professional looking for tax relief

- Someone curious about building wealth through real estate

This workshop will give you clarity on how the tax code can work for you, not against you.

What You’ll Learn

✔️ How real estate investors legally reduce their tax burden

✔️ Key tax advantages of owning real estate

✔️ Common tax mistakes investors make (and how to avoid them)

✔️ How to align your tax strategy with your wealth goals

✔️ Action steps you can take before the next tax season

Meet the Speakers

Pacifico Dumbrique

CashFlow Coach | Co-Founder | Real Estate Investor

Amy Bersamin

CashFlow Coach | Co-Founder | Real Estate Investor

CTEC Registered Tax Preparer

Elijah Baldwin

Enrolled Agent | Owner | Real Estate Investor

Event Details

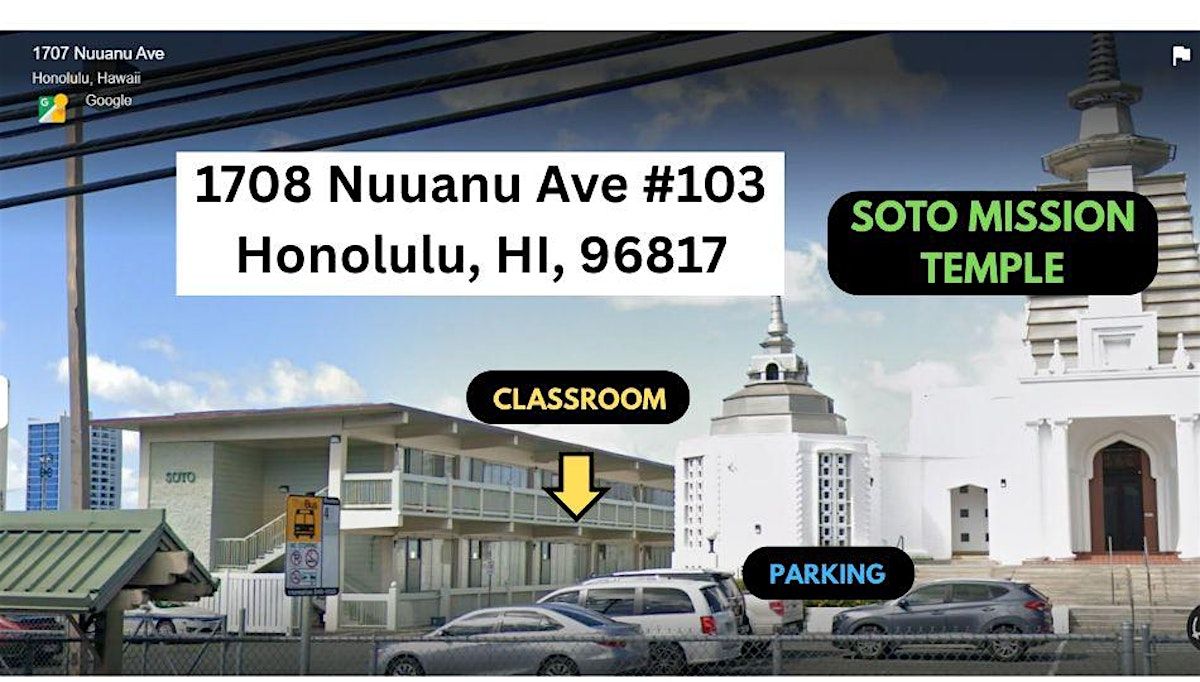

📅 Friday, January 30, 2026

⏰ 6:00 PM – 8:00 PM

📍 1708 Nuuanu Avenue, Honolulu, HI 96817

🎟️ FREE | In-Person Only

👉 Space is limited. Registration required.

Reserve your seat today and start learning how to keep more of what you earn and pay less in taxes—legally.

Event Venue & Nearby Stays

Soto Mission of Hawaii Shoboji, 1708 Nuuanu Avenue, Honolulu, United States

USD 0.00