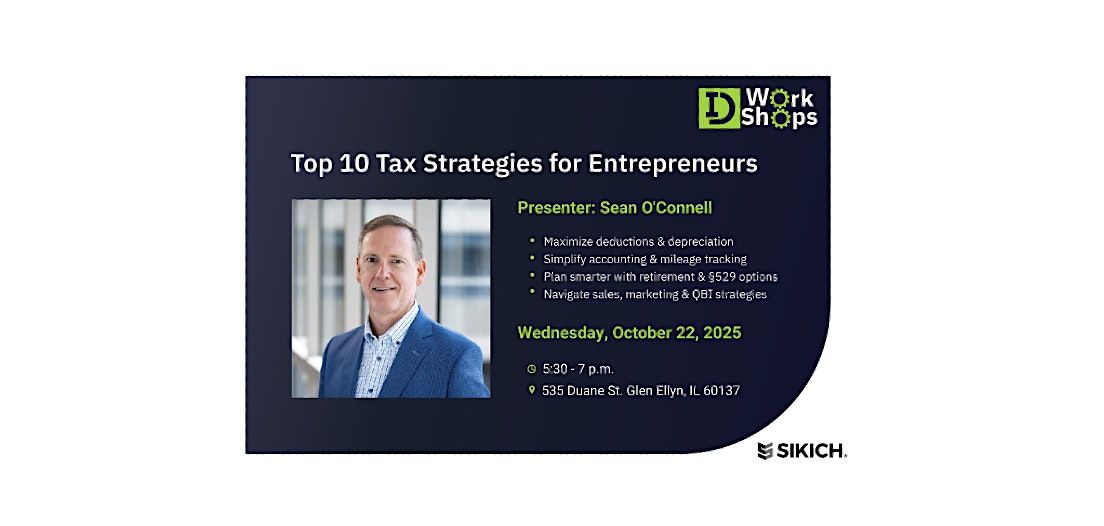

About this Event

Running a small business means wearing many hats—and understanding your tax options can make a big difference. Join us for a practical, entrepreneur-focused session that breaks down key financial strategies to help you save money, stay compliant, and plan for growth.

What You’ll Learn:

· How to choose the right accounting system and track mileage effectively

· Smart ways to leverage §179 and bonus depreciation

· Tips and overtime rules every employer should know

· Expanded §529 education savings (up to $20,000 for K–12)

· Qualified Small Business Stock and SALT deduction strategies

· Home office deductions and hobby loss rules

· Maximizing the QBI deduction for pass-through entities

· Retirement plan options like SEP and 401(k)

Who Should Attend:

Entrepreneurs, freelancers, small business owners, and anyone looking to strengthen their financial foundation.

Why It Matters:

This session is designed to be clear, actionable, and relevant—no jargon, no fluff. Just the insights you need to make smarter financial decisions and avoid common pitfalls.

Reserve Your Spot Today!

Register now to secure your seat.

Event Venue & Nearby Stays

535 Duane St, 535 Duane Street, Glen Ellyn, United States

USD 0.00