Buy. Rehab. Rent. Refi. Repeat.

Maybe your words are Buy. Rehab. Flip.

Both models work — just maybe not quite as well as they did when rates were 2-3%, houses were selling in 20 minutes, and everything didn’t cost so much.

Yes, you're still making a profit…

But it’s probably not as passive as you’d hoped.

And maybe a lot more stressful than you’d like.

Meanwhile, the lenders in those same deals?

They’re still getting paid.

- They’re not rehabbing houses or managing contractors

- Not filling vacancies or juggling lease agreements

- Not worrying about what new crazy regulation the city is going to throw at them.

They don’t own the house.

They own the debt.

And that debt pays them.

Every. Single. Month.

Ready to start thinking like a banker?

Then join us at the next MAREI meeting on January 13th, where Attorney Jeff Watson will pull back the curtain on how everyday investors are stepping into the lender’s seat — and reclaiming control, consistency, and peace of mind.

Jeff will break down:

- Why predictable income is the new gold standard in today’s volatile market

- How mortgage notes deliver monthly cash flow — without tenants, toilets, or trauma

- Why banks always get paid first — and how you can, too

- How smart investors are shifting from landlord to lender (and reclaiming their time)

- Why waiting costs more than taking strategic action now

Want to go deeper than what we can cover in 90 minutes?

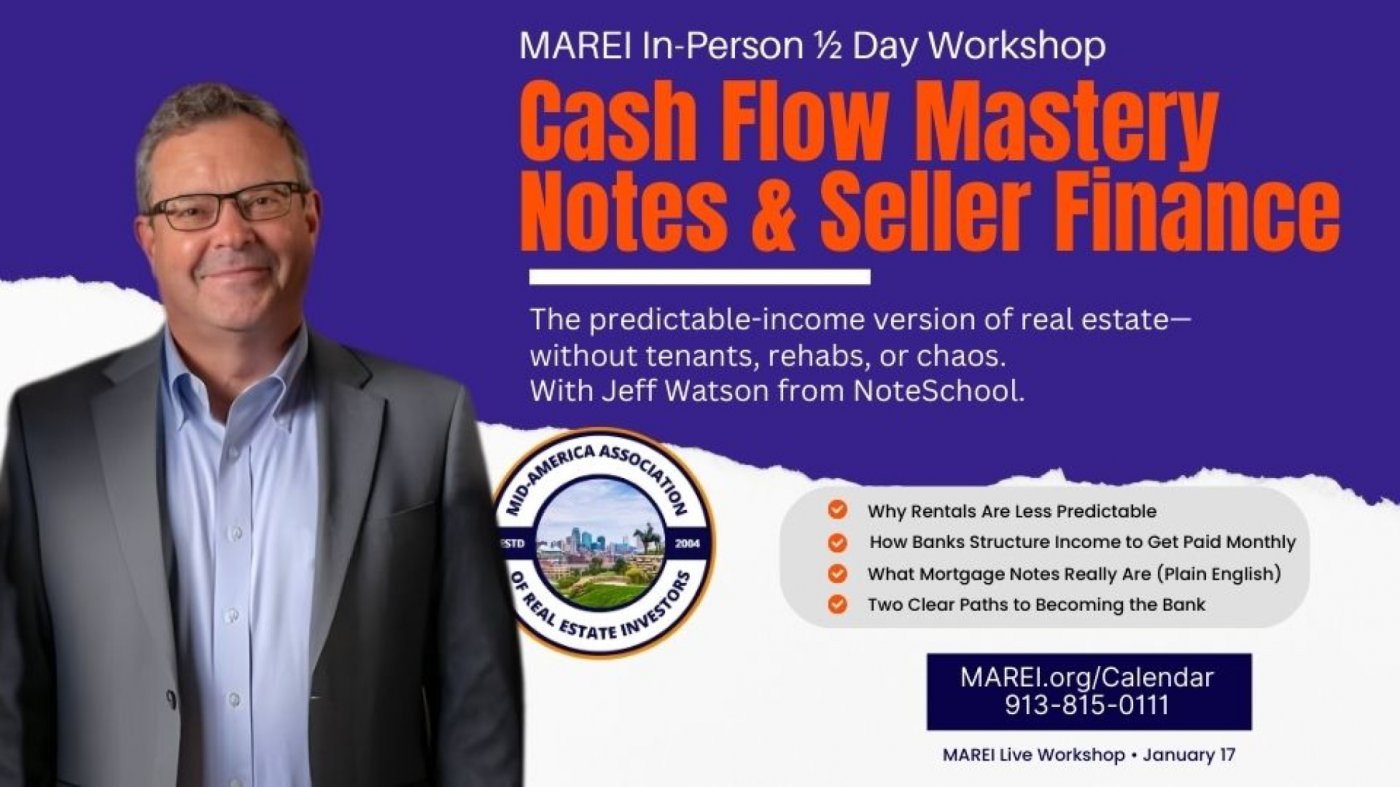

We talked Jeff into coming back for a special half-day workshop on Saturday, January 17th, where he’ll take you behind the scenes and show you how the model actually works — from deal design to investor discipline. (We don't get many live Saturday Workshops, this is not on Zoom, so take advantage)

He’ll show you:

- What’s really making rentals feel less stable and more stressful

- How monthly income systems are engineered for reliability

- The key mechanism that makes note investing profitable — without property headaches

- How to build in layers of protection that guard both your capital and your peace of mind

- The most common (and costly) rookie mistakes — and how to avoid them from day one

This isn’t theory.

It’s a strategy that Jeff and NoteSchool have used for decades. Strategy I used to build a portfolio of cash flowing notes back in 2013 & 2014. And it’s being used by savvy investors right now — quietly, profitably, and with far less stress.

Ready to add a new tool to your investor toolbox?

Whether it’s a backup plan, a way to diversify a few deals, or a total strategy shift…

RSVP for the January 13th MAREI Meeting

h 5:30 to 8:30 pm | DoubleTree, Overland Park

eNo Cost for MAREI Members & First-Time Guests

($35 guest fee for returning visitors)

MAREI.org - click on the calendar tab

Register for the January 17th Half-Day Workshop

P 9:00 am to 2:00 pm | Keller Williams Training Room – College Blvd

$47 for MAREI Members • $97 for Non-Members • Add Partner or Family for $20 more. (Not a member? Join for as little as $25/month and save!)

Go to MAREI.org and click on the calendar tab

Event Venue & Nearby Stays

Parrish Team - Keller Williams Realty Partners Inc., 6850 College Blvd, Overland Park, KS 66211, United States