Advertisement

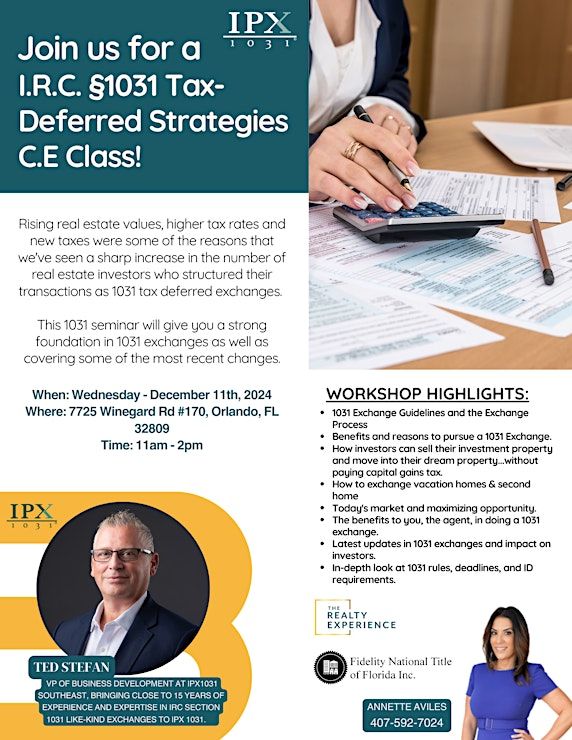

This 1031 seminar will give you a strong foundation in 1031 exchanges as well as covering some of the most recent changes.About this Event

Rising real estate values, higher tax rates and new taxes were some of the reasons that we've seen a sharp increase in the number of real estate investors who structured their transactions as 1031 tax deferred exchanges.

This 1031 seminar will give you a strong foundation in 1031 exchanges as well as covering some of the most recent changes.

**Light Bites will be provided!**

Workshop Highlights:

- 1031 Exchange Guidelines and the Exchange Process

- Benefits and reasons to pursue a 1031 Exchange.

- How investors can sell their investment property and move into their dream property...without paying capital gains tax.

- How to exchange vacation homes & second home

- Today's market and maximizing opportunity.

- The benefits to you, the agent, in doing a 1031 exchange.

- Latest updates in 1031 exchanges and impact on investors.

- In-depth look at 1031 rules, deadlines, and ID requirements.

Advertisement

Event Venue & Nearby Stays

Cosentino, 7725 Winegard Road, Orlando, United States

Tickets

USD 0.00