About this Event

What better way to kick off our 2025 First Fridays Series! The working capital pilot program may be exactly what you need to position your business for success in 2025! So if you’re a small, veteran, minority or woman owned small business in need of a cash infusion for your business, join us as we learn how the WCP will empower lenders to help you find innovative loan solutions for your business under the SBA 7a loan program!

"Small businesses need affordable working capital to pursue revenue growth opportunities made available thanks to President Biden’s Investing in America-agenda,” said SBA Administrator Guzman.“The SBA has expanded access to capital and increased small dollar lending over the past three and a half years – now, we are strengthening loan offerings through this new 7(a) Working Capital Pilot program to provide growth-oriented small businesses with competitively-priced lines of credit to fund orders and projects as they scale. The Biden-Harris Administration continues to level the playing field and ensure small businesses can compete, create jobs, and strengthen our nation’s economy.”

The SBA established the Working Capital Pilot Program to create a more flexible loan product to meet the market needs of our nation’s growth-oriented small businesses and give more options to SBA’s network of lenders when structuring a line of credit.

This new program will allow small businesses to fund individual projects or orders, enabling access to working capital earlier in the sales cycle; plus it will provide small businesses with a cost-effective way to access working capital against their assets, allowing small businesses to better manage their cash flow while also supporting supply chain resiliency.

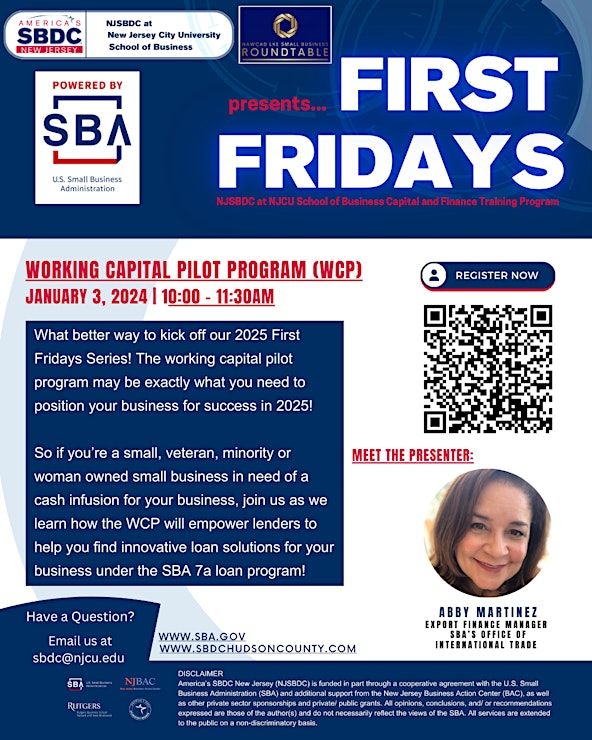

Meet the Presenter:

Abby Martinez is the Export Finance Manager for SBA’s Office of International Trade serving the New York and New Jersey markets. In this role, she is responsible for business development and lender outreach efforts.

In addition, Abby has over 25 years of experience as a trade specialist in the banking industry working at global, regional and community banks. Throughout her career, she has specialized in traditional bank trade solutions as well as Trade Finance solutions. She has worked directly with government-guaranteed programs as well as insured receivables financing and supply chain financing to provide solutions to exporters on ways to grow their international business and maximize their working capital.

Abby is bilingual and earned a Bachelor’s Degree in Business Administration from Florida International University with a double major in International Business and Management.

Event Venue

Online

USD 0.00