About this Event

LEVEL 2 (INTERMEDIATE) : Financial Statement Analysis: Profitability Ratio, Liquidity Ratio and Efficiency Ratio by RISE

Course duration: 1 day

Level 2: Intermediate – For participants with some understanding, focusing on enhancing and applying skills.

Course Background

The workshop is designed for entrepreneurs and business owners to develop the skills to analyze financial statements and make informed decisions based on financial data. Financial statement analysis is a critical component of any business, as it helps to identify potential areas of improvement, assess financial risk, and make informed financial decisions.

With in depth understanding of financial statements, business owners can use them to build important ratio that is commonly used such as profitability ratio, liquidity ratio, efficiency ratio and others.

Objectives

- Introduction to Financial Ratios

- Learn importance of financial ratios and explore the different types of ratios

- Learn Dupont framework: ROE

- Learn Financial Leverage, Asset Turnover and Net Profit Margin

- Learn Profitability Ratios: measurement of the ability of the business to generate profits from sales

- Learn Liquidity Ratios: measurement of business ability to meet its short-term financial commitments

- Learn Efficiency Ratios: measurement of business ability to use its assets and resources effectively to generate sales and profits.

- Learn the best ratio for each and some strategies to improve current ratios

Learning Outcomes

- Develop a foundational understanding of financial ratios, aligning with the introduction to financial ratios.

- Recognize the importance of financial ratios and explore various types, including profitability, liquidity, and efficiency ratios.

- Master the analysis of Profitability Ratios, understanding their role in measuring the business's ability to generate profits from sales.

- Acquire proficiency in interpreting Liquidity Ratios, focusing on assessing the business's capability to meet short-term financial commitments.

- Learn the intricacies of Efficiency Ratios, emphasizing the measurement of the business's ability to use assets effectively for generating sales and profits.

- Understand the significance of selecting the best ratio for each scenario and explore strategies to improve current ratios.

- Develop skills in effectively communicating findings to stakeholders and benchmarking business performance against competitors.

- Apply learned concepts to assess and compare the financial performance of different companies or industry benchmarks, aligning with the workshop's objectives.

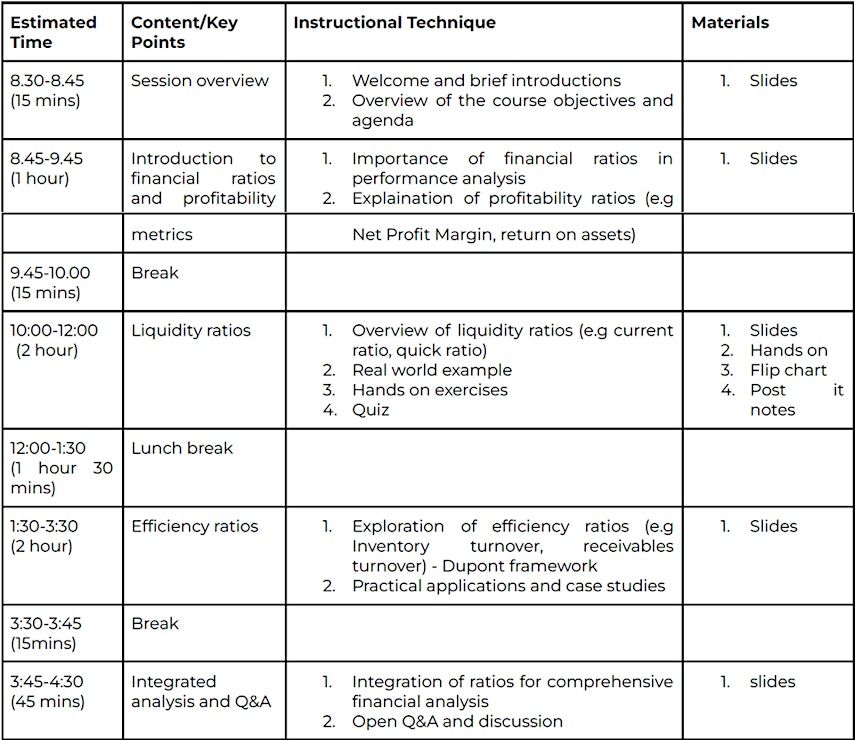

Course Content

Who should attend?

- Finance Professionals: Individuals in finance roles aiming to deepen their knowledge of financial ratios for enhanced financial analysis.

- Business Owners and Entrepreneurs: Individuals interested in understanding and applying financial ratios to assess and improve the financial health of their businesses.

- Financial Analysts and Managers: Professionals seeking to strengthen their analytical skills in profitability, liquidity, and efficiency ratios for more informed decision-making.

- Operations Managers: Individuals responsible for optimizing business processes, interested in using efficiency ratios to improve operational effectiveness.

- Accounting Professionals: Accountants and financial experts looking to enhance their expertise in financial ratios for comprehensive financial reporting.

- Students and Educators: Individuals studying or teaching finance-related subjects, wanting to grasp the fundamentals of financial ratios and their application.

What to bring?

Laptops/ Tablet, notebooks and pens

Don't miss this amazing chance to learn from experts and network with fellow entrepreneurs. Reserve your spot now and get ready for an exciting journey to entrepreneurial success!

Event Venue & Nearby Stays

iCentre Auditorium, Simpang 32-37, Bandar Seri Begawan, Brunei Darussalam

USD 0.00