About this Event

💡 Group Discount Alert – Learn More, Save More Together!

🎟️ Check tickets now for exciting group discounts!

Duration: 1 Full Day (9:00 AM – 5:00 PM)

Delivery Mode: Classroom (In-Person)

Language: English

Credits: 8 PDUs / Training Hours

Certification: Course Completion Certificate

Refreshments: Lunch, beverages, and light snacks included

Course Overview

This course is designed to help business owners and decision-makers gain a clear understanding of a company’s financial health through the effective use of key financial ratios.

Participants will learn how profitability, liquidity, and efficiency ratios reflect overall business performance, financial stability, and operational strength. The program emphasizes practical interpretation rather than accounting theory, enabling better decision-making in areas such as pricing, cost management, cash flow planning, and business growth.

Through realistic business scenarios, financial data is connected directly to day-to-day management and strategic decisions.

Learning Objectives

By the end of this course, you will be able to:

- Understand the purpose and strategic importance of financial ratio analysis

- Confidently interpret profitability, liquidity, and efficiency ratios

- Evaluate overall business performance using financial data

- Identify financial strengths and potential risks at an early stage

- Support strategic and operational decisions using ratio-based insights

- Avoid common errors in ratio interpretation and analysis

Target Audience

- Business owners and entrepreneurs

- Startup founders

- Small and medium enterprise (SME) managers

- Finance and accounting professionals

- Operations and strategy managers

- Non-finance managers involved in business decision-making

©2026 Catils. This content is protected by copyright law. Copy or Reproduction without permission is prohibited.

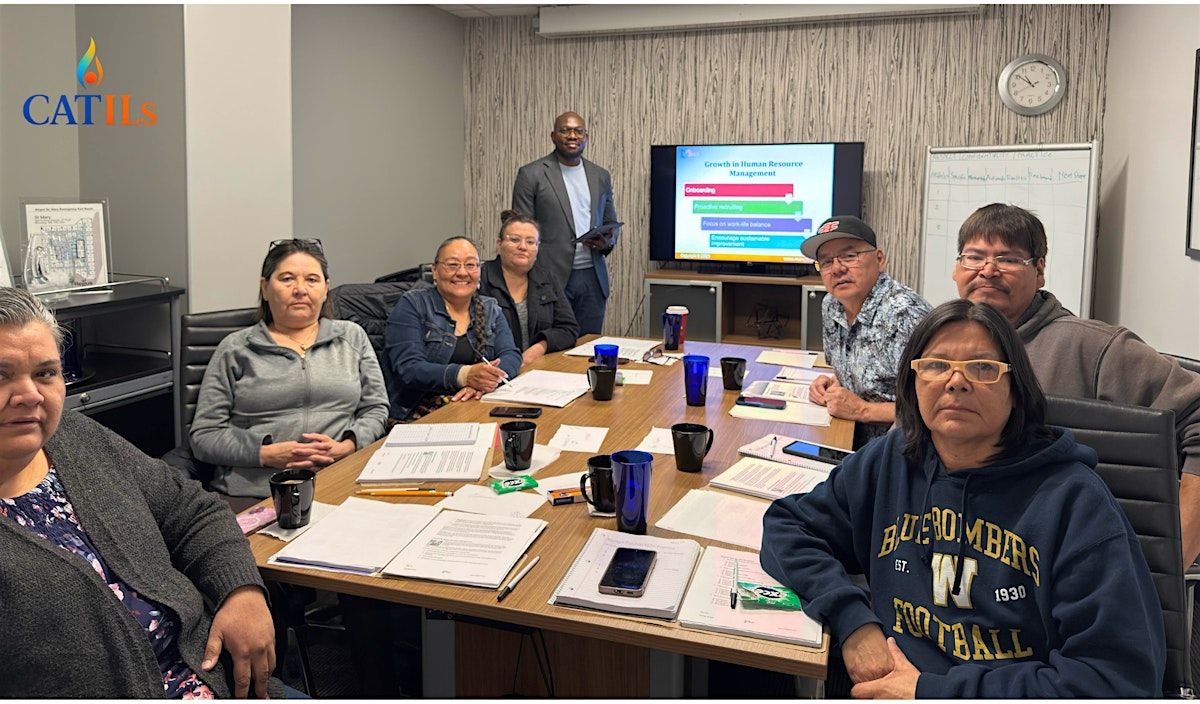

Why Is This the Right Fit for You?

This course is specifically designed for business decision-makers—not accountants. The focus is on clarity, practical application, and real-world relevance rather than complex calculations.

Led by a trainer with strong hands-on experience in financial analysis and business consulting, the program ensures that concepts are directly applicable to real business situations.

Complex financial ratios are explained in simple, accessible language with a strong emphasis on interpretation and insight. Participants leave with greater clarity, increased confidence, and practical tools they can immediately apply to improve business performance and support smarter decision-making.

📧 Contact us today to schedule a customized in-house, face-to-face session: [email protected]

Agenda

Module 1: Understanding Financial Statements Basics

Info: • Understand how income statements, balance sheets, and cash flow statements connect

• Identify key figures required for ratio analysis

• Recognize common financial reporting patterns

• Icebreaker

Module 2: Profitability Ratios – Measuring Business Performance

Info: • Understand gross profit, net profit, and operating margins

• Analyze return on assets and return on equity

• Evaluate pricing and cost efficiency using ratios

• Case Study

Module 3: Liquidity Ratios – Assessing Short-Term Financial Strength

Info: • Understand current ratio and quick ratio

• Evaluate the ability to meet short-term obligations

• Identify early warning signs of cash stress

• Simulation

Module 4: Efficiency Ratios – Improving Operational Effectiveness

Info: • Analyze inventory turnover and receivables turnover

• Understand asset utilization efficiency

• Identify operational bottlenecks using ratio trends

• Activity

Module 5: Ratio Interpretation & Trend Analysis

Info: • Compare ratios across periods for performance tracking

• Understand industry benchmarking concepts

• Avoid common misinterpretation of ratios

• Case Study

Module 6: Using Ratios for Business Decisions

Info: • Apply ratios to pricing, expansion, and cost control decisions

• Support funding and investor discussions with ratios

• Link financial ratios to strategic goals

• Role Play

Module 7: Red Flags, Limitations & Best Practices

Info: • Understand limitations of ratio analysis

• Identify manipulation risks and misleading figures

• Follow best practices for reliable analysis

• Activity

Event Venue & Nearby Stays

Regus 120 Collins Street, 120 Collins Street#Levels 31 & 50, Melbourne, Australia

AUD 529.68 to AUD 635.56

![POKEMON Trivia at The Oxford Scholar Hotel [OXFORD]](https://cdn-ip.allevents.in/s/rs:fill:500:250/g:sm/sh:100/aHR0cHM6Ly9jZG4tYXouYWxsZXZlbnRzLmluL2V2ZW50czcvYmFubmVycy9hYThkYjhjZjFmYWEwYWJiZmVjYzExMTgxOGQ5MWI1NjFkMWNhYzE4NzgwMWRjODJjYjY3ZGVjNDg1MWRkMTgxLXJpbWctdzEwMjQtaDM3NC1kYzE3MTIxNC1nbWlyLmpwZz92PTE3NjY5MDA3NjU.avif)