About this Event

Are You Prepared for Retirement?

Retirement planning is more than just saving money—it’s about maximizing income, reducing tax burdens, and securing a financially confident future. In this exclusive FREE educational seminar, we’ll break down key retirement strategies to help you plan effectively.

What You’ll Learn:

📌 Tax Rate Risk

- Why some experts believe tax rates could rise and how it may impact you

- How rising taxes can affect your retirement income

- The “Catch 22” of 401(k)s and IRAs

- How lost deductions could increase your tax liability in retirement

📌 Retirement Income Planning

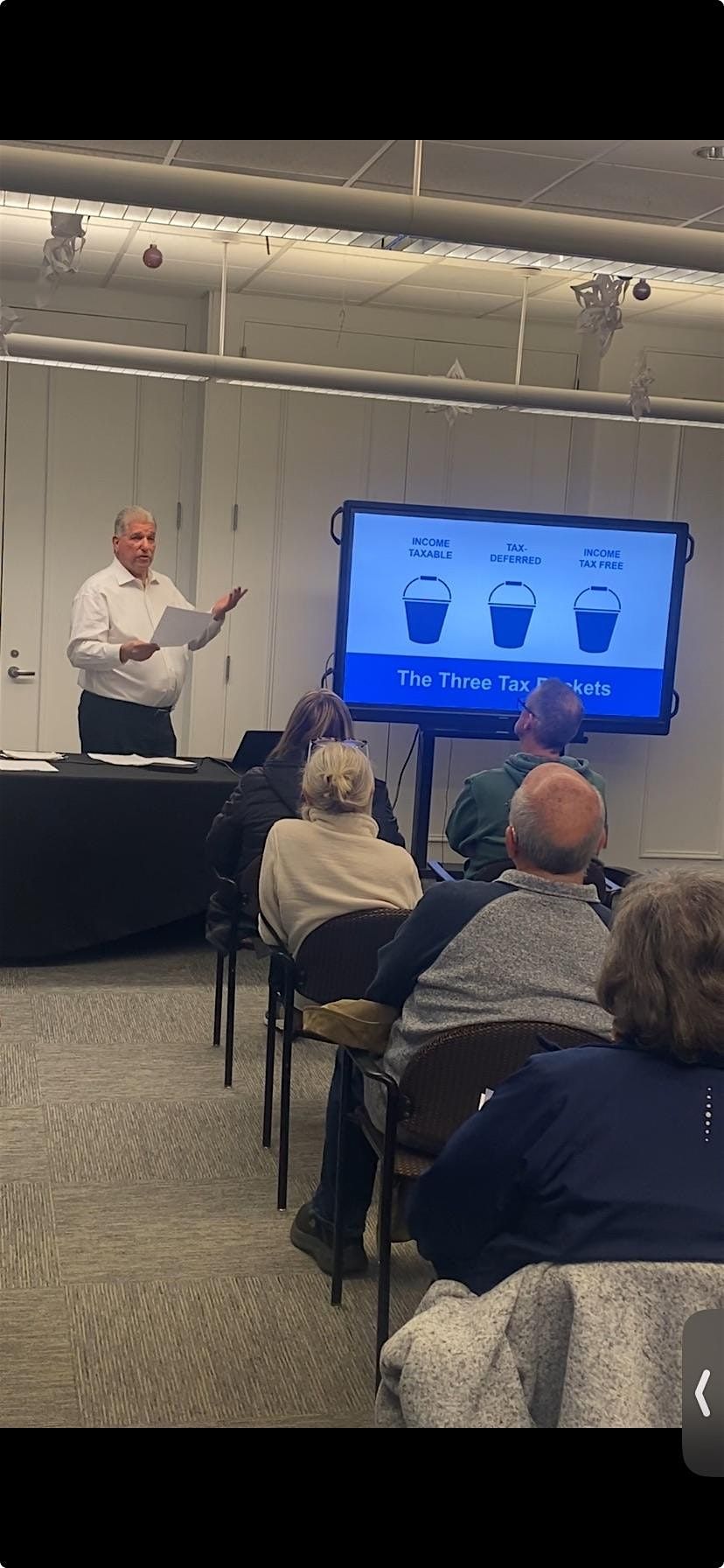

- The three basic types of retirement accounts and how they work

- How to strategically allocate savings for long-term financial security

- Tax-deferred vs. tax-free accounts: Which is right for you?

- Ways to reduce or eliminate unnecessary taxes in retirement

📌 Maximizing Social Security

- The real cost of Social Security taxation

- How to avoid common Social Security mistakes

- The key thresholds you need to know

- How to maximize your benefits for a stronger retirement

Who Should Attend?

This event is perfect for pre-retirees and retirees who want to reduce taxes, maximize retirement income, and make informed Social Security decisions.

✅ No cost to attend

✅ No financial products or services will be sold—strictly educational

✅ Seats are limited—RSVP now!

Event Venue & Nearby Stays

ExecuBusiness Centers, 10130 Mallard Creek Road, Charlotte, United States

USD 0.00