About this Event

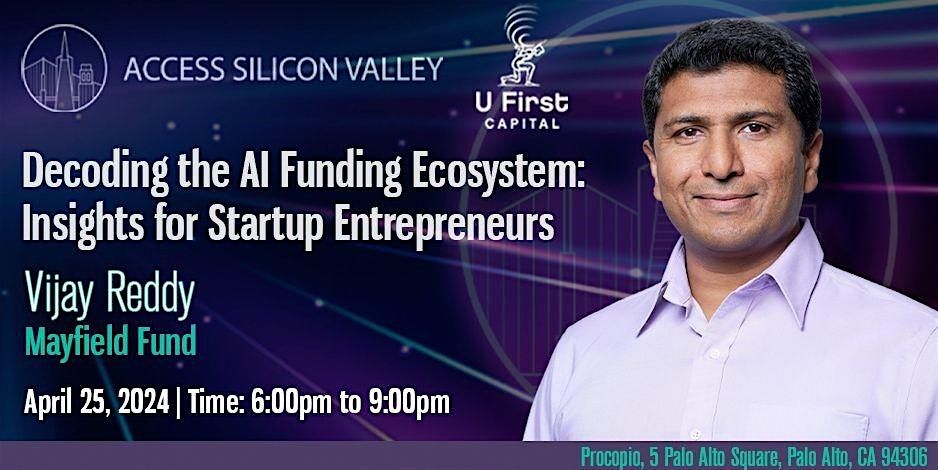

Are you ready to delve into the world of entrepreneurship and venture capital? and invite you to join us on April 25, 2024, for an EXCLUSIVE one-night only discussion with , a partner at the, one of the hottest, most innovative, and respected venture capital firms in Silicon Valley, who have recently closed on the $250.0 million AI Start Fund, focusing on Seed stage AI companies. Mayfield has raised more than 20 U.S. funds, has more than 120 IPOs, 225 M&A exits, $3.0B under management and made more than 550 investments in startups.

SEATING IS EXTREMELY LIMITED, SO RESERVE YOURS NOW!

In this Unleashed event (we call it "unleashed" because this event will be interactive, audience driven), Vijay will delve into the dynamic landscape of entrepreneurship and venture capital and the rapidly changing world related to AI and AI investments. Vijay has a unique experience to share—he co-founded his first startup after dropping out of his PhD program, and held several senior Business Development and Product Development roles at Broadcom and Intel. He has over a decade of inception and early-stage investing experience in AI and deeptech, from Clear Ventures, Intel Capital and Mayfield. Vijay has invested across the AI stack from silicon, systems, infrastructure software, data, middleware & tools and applications.

AGENDA

6:00pm - 7:00pm: Dinner, refreshments and networking

7:00pm - 7:45pm: Conversation with Vijay

7 :45 -8:00: Audience Q&A

8:00pm - 9:00pm: Networking

ABOUT VIJAY

Vijay brings over a decade of inception and early-stage investing experience in AI and deeptech, from Clear Ventures and Intel Capital. He had a front-row seat to the rise of AI when neural networks first beat human benchmarks in vision, speech and language. Vijay has invested across the AI stack from silicon, systems, infrastructure software, data, middleware & tools and applications. Some of his past investments include SambaNova, DataRobot, Lilt, Landing.ai, Hypersonix, Joby (NYSE: Joby), BabbleLabs (Acquired by Cisco) and AEye (Nasdaq: LIDR).

As a former R&D engineer, Vijay enjoys collaborating with leading technical innovators and researchers who are leveraging bold, disruptive ideas with extreme clarity of purpose to build best in class companies. He takes a founder-first and team-oriented approach and works tirelessly with inception stage entrepreneurs to achieve product market fit and help them scale rapidly.

Vijay began his career as an entrepreneur when he co-founded his first startup after dropping out of his PhD program. He has also held several senior Business Development and Product Development roles at Broadcom and Intel where he was hired into the Accelerated Leadership Program, designed to groom the next generation of leaders.

A Kauffman Fellow, Vijay received his MBA from the University of Chicago Booth School of Business and has a BS & MS in Electrical and Computer Engineering with top honors from University of California, Irvine.

ABOUT MAYFIELD

Mayfield is a venture capital firm with a 50+ year track record of investing at the inception stage in iconic enterprise, consumer, semiconductor, and human & planetary health companies. It is guided by its People First philosophy and is proud to have served as early investors to over 550 companies leading to 120 IPOs and over 225 M&As. Its investment team operates from a shared set of beliefs and partners for the long term with entrepreneurs pursuing big ideas. Mayfield invests in new companies at the inception and early stages, primarily Seed, Series A, and Series B. They have raised 20 U.S. funds over, including the two most recent funds, the $580M Mayfield XVII, the $375M Mayfield Select III and the most recent $250M Mayfield AI Start Seed Fund.

ABOUT ROGER RAPPOPORT AND ACCESS SILICON VALLEY

is a former entrepreneur and the founder and leader of Procopio's Emerging Growth and Venture Capital Practice Group. He has extensive experience in advising startup and well-established emerging growth companies across all sectors and industries, from formation through multiple rounds of funding and exit.

Roger is an active angel investor and a frequent speaker and panelist on topics and issues related to the development and implementation of a company's formation and funding strategy. Before attending law school, he was the founder of a technology company. As an emerging growth and venture capital attorney, he has been involved in hundreds of transactions such as merger and acquisition transactions, private equity and venture capital financing transactions, and complex restructuring transactions.

Roger is also the founder of , a platform for entrepreneurs, on a global basis, to gain access to Silicon Valley's best and brightest Venture Capitalists, "been there done that" entrepreneurs, and experts. Take a closer look at the Access Silicon Valley Video Fireside Chat Series hosted by Roger, with representatives of some of the Valley's most high profile VCs, such as Andreessen Horowitz, Foundation Capital, Floodgate, Mayfield, Venrock, Canaan Partners and more.

ABOUT U FIRST CAPITAL, EKTA DANG AND SANJIT DANG

s a prominent venture capital firm specializing in early-stage investments and dedicated to supporting innovative startups. With a rich history and a strong track record, U First Capital has been at the forefront of fostering entrepreneurship and driving technological advancements.

Our experienced team of investors and industry experts possess a deep understanding of emerging trends and market dynamics. We carefully select visionary founders and disruptive ideas across a range of sectors, including technology, healthcare, fintech, and more. By providing crucial funding, strategic guidance, and invaluable resources, we empower entrepreneurs to transform their concepts into successful businesses.

At U First Capital, we prioritize long-term partnerships and actively engage with our portfolio companies. We offer mentorship, operational support, and access to our extensive network of industry connections, enabling startups to accelerate their growth and overcome challenges. We pride ourselves on being more than just financial backers; we become trusted allies on the entrepreneurial journey.

Dr. Ekta Dang is the Co-Founder and CEO of U First Capital and drove venture capital investments at Intel prior to that. She has an excellent track record of achieving at least 1 Exit every year: Pensando (Acquired by AMD in 2022), Nextdoor (IPO 2021), Palantir (IPO 2020), Orb Intelligence (Acquired by Dun and Bradstreet in 2020), Pinterest (IPO 2019), Docusign (IPO 2018), etc. She has invested in category-leading companies such as SpaceX, Uniphore, Pensando, and DevRev.

Dr. Dang is a member of Congressman Ro Khanna’s Leadership Circle and advises him on technology policy. She is also an Advisor to the Chancellor of the University of California San Diego and has been on the Science Translation and Innovative Research (STAIR) Grant Committee of the University of California Davis. She is also an Advisor to Israel’s Ben-Gurion University of the Negev. She is a Contributing Writer for Venture Beat.

She has been a successful Venture Capital Investor, Corporate Executive, Speaker, and Writer in Silicon Valley for two decades. At Intel, she has solid experience both in Venture Capital and on the operating side. She brings a stellar network from the Venture Capital and Corporate world to the startups. She has been a mentor at Alchemist Accelerator, Stanford, UC Berkeley, Google Launchpad, etc. She is an invited Speaker at several top Venture Capital/Startup conferences, like TiECon, Silicon Valley Open Doors, etc. She has also co-chaired TiECon’s entrepreneurship track.

She has a Ph.D. in Physics (Electronics) and has attended UC Berkeley Haas School's Venture Capital Executive Program. She has published several research papers in IEEE and other reputed international journals.

has been a successful Venture Capitalist, Corporate Executive, Board Member, Speaker and Writer in Silicon Valley for almost two decades. He is currently the Co-Founder and Chairman of U First Capital. They provide Venture Capital as a Service to Corporations by bringing Startups, University IP, etc in the Corporate's specific areas of interest (dedicated model). Prior to that, he was at Intel Capital where he led Venture Capital investments in Enterprise Software. He has been an Investor and on the Board of several companies, including True Fit (AI for eCommerce, Raised $100M), Reflektion (AI recommendation for eCommerce, Raised $42M), Helpshift (AI-driven Customer Service, Raised $38M) and Enlighted (Smart Lighting, Acquired by Siemens in 2018). He is also an investor in Mirantis (Cloud Computing, raised >$100M), GoodData (SaaS Business Intelligence, raised over $100M) and Arcadia Data (Big Data 2.0, Raised $26M).

He is on the Advisory Council of UN’s World Artificial Intelligence Organization. He has also been on University of California President's Innovation Council. Sanjit has the fastest Engineering PhD from University of Illinois (2yrs 9mo after undergrad), which he received in 2000 with top research awards. He also attended the VC Executive program at Haas School of Business, UC Berkeley. He’s an invited Speaker at several top conferences, eg SURGE/WebSummit, Venture Summit West, TiECon, Collision, ShopTalk, McKinsey Leadership Summit, Silicon Valley Open Doors, Global AI conference, etc. He’s a mentor at Stanford and Berkeley’s Entrepreneurship programs.

Sanjit has over a decade of Executive leadership experience in Product Design, Business Development and Strategy across several domains: Big Data, Natural Language Processing, 3D Camera/Apps, Supply-Chain Analytics and Flash Memory. He has managed $2Bill/year accounts and executed >30 partnership deals in $100M-$2Bill range. Always striving to be ahead of the curve, Sanjit worked on Big Data Analytics before industry created the term 'Big Data'. Similarly, he launched 2 online courses during graduate school in 1999 and published iconic papers on learnings, way before the MOOC revolution started.

Photo and Video Disclaimer:

By attending Access Silicon Valley events, you understand that you may be photographed or videotaped. You agree to allow your photo, video, or film likeness to be used for any legitimate purpose by the event hosts, producers, sponsors, organizers, assigns, and/or by anyone involved in the event in any capacity. This includes usage on social media platforms.

Your email address will be shared with Procopio and U First for the purposes of sending you invitations to upcoming venture capital and other startup events.

PREMIER SPONSORS:

Procopio- An AMLAW 200 firm, ranked among the Best Law Firms by U.S. News & World Report

Event Venue & Nearby Stays

Procopio, Cory, Hargreaves & Savitch LLP 1st Floor, 5 Palo Alto Square, Palo Alto, CA 94306, United States

USD 0.00 to USD 40.00