About this Event

Group Discounts:

- Save 10% when registering 3 or more participants

- Save 15% when registering 10 or more participants

For more information on venue address, reach out to "[email protected]"

About the Course:

Duration: 1 Full Day (8 Hours)

Delivery Mode: Classroom (In-Person)

Language: English

Credits: 8 PDUs / Training Hours

Certification: Course Completion Certificate

Refreshments: Lunch, Snacks and beverages will be provided during the session

Course Overview:

This practical and engaging course helps you build strong customer experience and personalisation skills tailored for modern banking environments. You will learn how to understand customer needs, deliver high-quality service, and personalise interactions using clear communication and relationship-building tools. Through relevant examples and structured learning, you will discover how personalisation improves trust, loyalty, and long-term customer satisfaction. By the end, you will feel confident applying customer-centric methods that enhance overall service quality.

Learning objectives:

By the end of the course, you will:

- Understand how customer experience works within banking environments.

- Recognise key needs and behaviours to personalise interactions effectively.

- Communicate with clarity, empathy, and professionalism.

- Apply personalisation strategies that build trust and long-term loyalty.

- Handle concerns and difficult interactions with confidence and structure.

- Deliver consistent service across multiple channels.

- Strengthen your ability to improve customer relationships through daily habits.

Target audience:

Banking staff, service teams.

Why is it right fit for you:

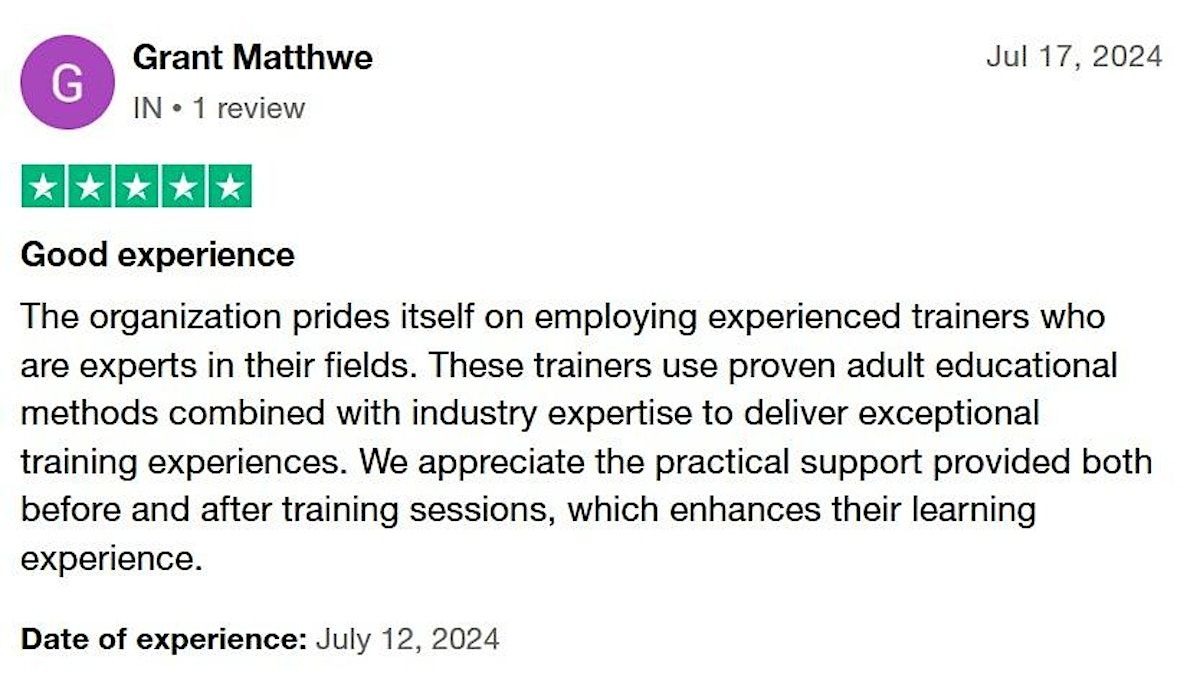

This course is ideal if you want to deliver exceptional customer service that stands out in today’s competitive banking environment. It provides practical techniques that you can apply immediately to personalise conversations and strengthen customer relationships. The training blends communication skills, behavioural insights, and process knowledge to help you serve more confidently and efficiently. Our approach ensures that you understand not only what to do but also why it works in real banking scenarios. By the end of the program, you will feel equipped to create meaningful and memorable customer experiences.

©2025 Catils. This content is protected by copyright law. Copy or Reproduction without permission is prohibited.

Looking to improve customer experience across your entire team?

We offer in-house training that can be fully customised to match your bank’s service standards, customer segments, and operational realities. Whether you want to enhance personalisation, strengthen communication, or upgrade overall customer service excellence, our tailored sessions ensure your teams build skills that directly improve customer satisfaction and loyalty.

📧 Contact us today to schedule a customized in-house, face-to-face session:

Agenda

Module 1: Foundations of Customer Experience in Banking

Info: • Understanding customer expectations

• Key drivers of satisfaction and loyalty

• Importance of personalised service in modern banking

• Activity

Module 2: Knowing Your Customer (KYC Beyond Compliance)

Info: • Identifying functional and emotional customer needs

• Customer behaviour patterns

• Building rapport and trust

• Activity

Module 3: Personalisation Techniques for Daily Interactions

Info: • Adapting conversations based on customer profiles

• Using customer data ethically

• Identifying opportunities for personalisation

• Activity

Module 4: Communication Skills for Enhanced CX

Info: • Professional verbal and non-verbal communication

• Empathy, clarity, and active listening

• Managing service tone and structure

• Role Play

Module 5: Handling Customer Concerns Effectively

Info: • Techniques to understand root causes

• Managing emotions and difficult interactions

• Turning negative moments into positive experiences

• Case Study

Module 6: Service Excellence & Process Awareness

Info: • Understanding service journeys end-to-end

• Removing friction and improving customer flow

• Aligning customer needs with internal processes

• Activity

Module 7: Digital Personalisation & Omnichannel Service

Info: • Using digital tools to improve service

• Consistency across phone, email, chat, and in-branch service

• Creating personalised experiences across touchpoints

• Case Study

Module 8: Continuous Improvement in Customer Experience

Info: • Gathering customer insights and feedback

• Improving service quality through small daily actions

• Using self-assessment and team reflection

• Activity

Event Venue & Nearby Stays

Albert Street & Metcalfe Street, 116 Albert Street Suite 200 & 300 Ottawa Ontario K1P 5G3 Canada, Ottawa, Canada

CAD 540.53 to CAD 704.06