About this Event

Unlock the IRS-approved strategy that turns every $1 you give into $5 in tax deductions.

As an investor, you already know the power of deductions: office expenses, car mileage, mortgage interest. But what if you could legally multiply your charitable giving into 5X the write-offs against your Adjusted Gross Income (AGI)?

That’s exactly what you’ll learn in this powerful session:

🔑 Key Takeaways:

- How AGI works and why lowering it is the ultimate tax strategy.

- Real-world examples: $25,000 charitable contribution = $125,000 in deductions.

- The difference between ordinary income deductions and investor deductions.

- How to qualify and file through a charitable program backed by the IRS.

- Why this program can not only eliminate your tax bill but also leave you with extra money in your pocket.

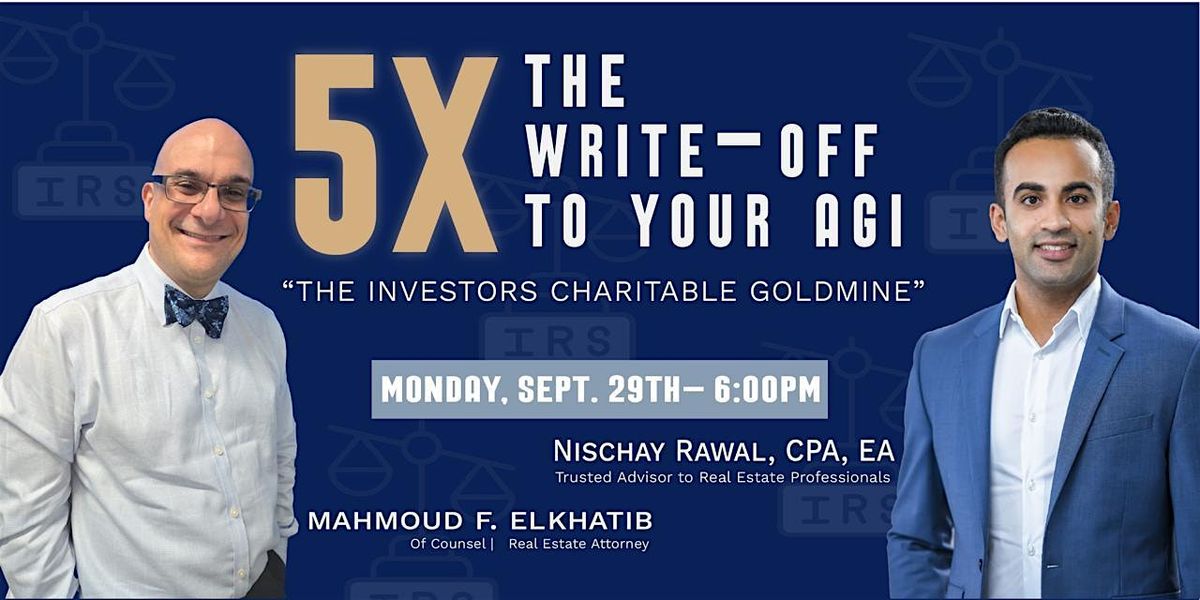

💡 Speaker Highlight:Nischay Rawal, CPA, works directly with a charitable company recognized by the IRS. His expertise in structuring these deductions gives investors a unique advantage that traditional CPAs often miss.

- Gross Income: $120,000

- Typical Deductions: $30,000 → AGI = $90,000

- With Charitable Program: $25,000 donation = $125,000 deduction → AGI = $0 (and potential refund).

👉 This isn’t theory — it’s a proven strategy for investors who want to maximize deductions, minimize taxes, and keep more cash in their business.

Event Venue & Nearby Stays

1333 Butterfield Rd, 1333 Butterfield Road, Downers Grove, United States

USD 33.83